Housing for People of Small Means: Worker’s Dwelling Act 1909

On 22 December 1909, the Queensland government passed “An Act to Enable the Government to Assist Persons in Receipt of Small Incomes to Provide Homes for Themselves”. Very understandable why the act was generally referred to as the Workers’ Dwelling Act 1909!

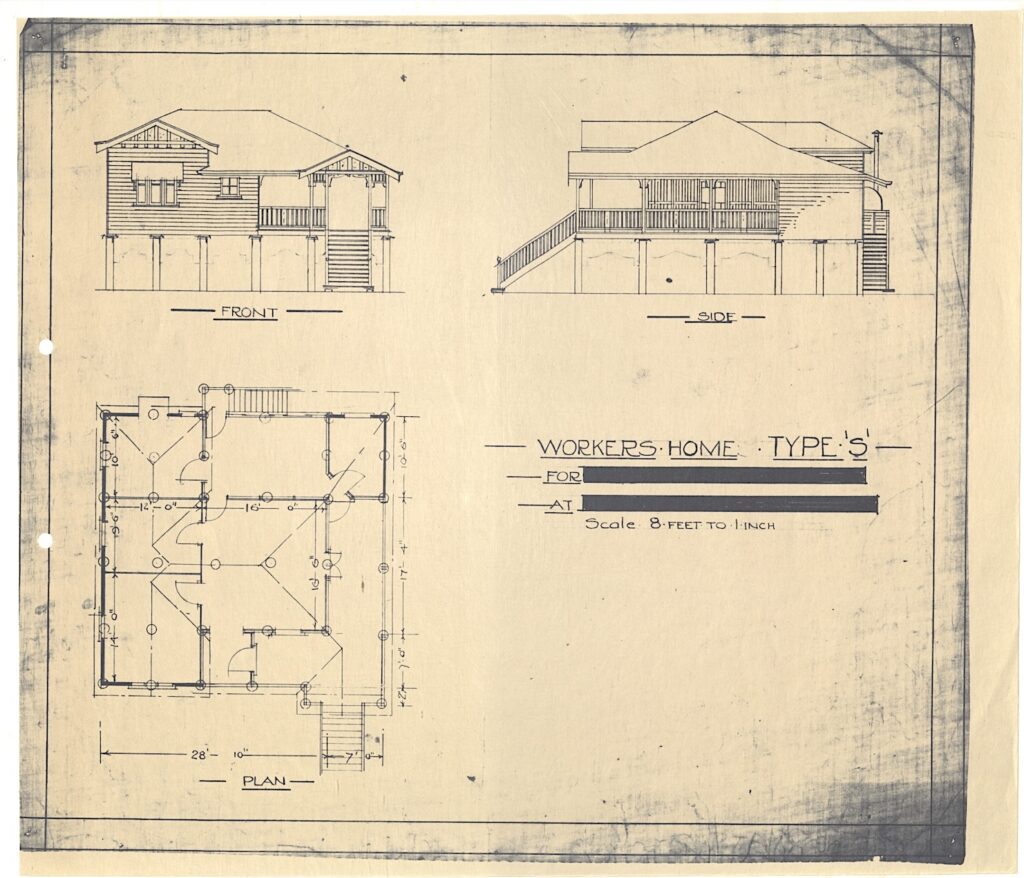

Workers Home Type S (two bedrooms). From Queensland State Archives

The aim was to provide a means for working class families to acquire a low interest mortgage to construct their home. The first home was built in 1910 and by the late 1920s 23,515 homes had been built under the scheme. There were strict requirements to access the scheme, the type of home to be built, how it was to be insured and maintained.

The funds necessary for the execution of the Act were to be raised by debentures to the extent of £250,000, and the Board was authorised to make advances up to 13/4 in the £1 to owners of freehold estate, or leaseholders under the Mining Act of 1898 or the Land Act of 1897, and who were not owners of dwelling houses in Queensland or elsewhere, and who were not in receipt of incomes of more than £200 per annum. Worker’s dwellers loans would be exempt from stamp duty in a bid to assist them further.

Requirements: Had to earn less than £200 gross income per annum, to own a piece freehold land free of encumbrances, or hold a miner’s homestead lease, or residence as granted under ‘The Mining Act 1898’ or a Town Lease. Had to be a British subject over 21 years. Could not own another dwelling in Queensland or elsewhere. Only then could the person then apply for a loan to build the house. The loan had to be used to build a home. It could not be used to buy a pre-existing home. The home had to be chosen from a set of standard plans.

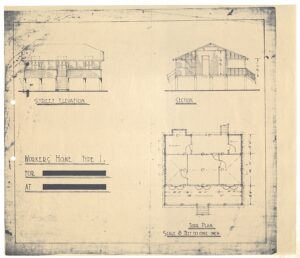

Workers Home Type I (two bedrooms). From Queensland State Archives

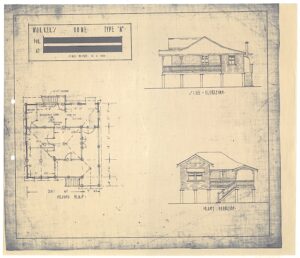

Examples of which can be seen at Queensland State Archives ITM1572645

Workers’ Homes Plan Books-(Workers Dwelling Board) which has been digitised and contains sample floor plans and sketches for the homes (1911-1915)

The loans were repayable over 20 years initially. You had to have a 33% deposit and the monthly instalments and these instalments included interest at 5%. The amount was calculated to fully repay the loan. You could pay more monthly to get ahead on the loan and give you a buffer. This was important as most people were not permanently employed and may have variable income throughout the year.

The scheme had to be cost-neutral for Government so all costs had to be borne by the applicant. This meant the applicant paid a fee to apply for the loan, had to provide copies of all the plans and had to pay all costs incurred by the Worker’s Dwelling Board.

The applicant was applying for a loan to build a home on their land. A mortgage over both land you owned and the home needed to be taken out and was held by the Department.

If successful the client had to maintain land and house in tenantable condition for the life of the loan. This meant the house needed to be painted every five years with two coats of the approved paint and within the approved colour range.

The client had to pay all rates, taxes and other expenses relating to the land & dwelling and had to insure the property. The client had to pay the monthly instalments. In the event they defaulted on a payment, there was a penalty for failing to pay on time, and arrears were charged at 10% interest. It was reported there was a very low default rate.

It was considered that the living wage for an unskilled labourer with three children was estimated to be £114 per annum in 1911. An engine driver, a skilled occupation but not a trade was listed as earning £187 per annum, both amounts well below the £200 maximum income for the scheme.

Workers Home Type M (two bedrooms). From Queensland State Archives

First homes built under the scheme were in Surrey Street Nundah. Mr & Mrs Weissner, were given a loan of £190 to fund the building of the home which cost £220 to build and the loan was to be repaid over 20 years at 5% interest. They had bought the land in June 1909 and applied for the loan 14 March 1910. The mortgage was released in 1925 when the property changed ownership.

Over 30 years it is known that 19 058 workers’ dwellings were erected, 612 discharged soldiers’ dwelling (under a variant of the scheme that was then taken over by the Commonwealth returned Soldiers scheme) and 2 294 workers’ homes giving a total of 21 964 known loans for dwellings.

There were amendments to the scheme during the time period raising the maximum amount that could be loaned, raising the maximum income that could be earned, allowing the wife’s income to be used in calculating whether the applicant could repay the loan changing the interest rate and in 1934 changing the loan term to 30 years which decreased the monthly repayment amounts.

The Board did implement a number of ways to help people through the Depression years and while there were some defaulters in this time frame the majority of persons were able to maintain their loans.

Finding out that your ancestor had one of these loans can sometimes be done by looking through Trove. The Board placed ‘Notices of Tenders’ for the building of the homes in the newspapers and often notices that the tenders had been accepted and who was the successful builder for the home.

The Queensland State Archives have register books of indexes to the loan files (up to 1955 in 21 books). Unfortunately it appears the actual files relating to the loans were not considered archival material and were not retained but you can obtain a fair amount of information relating to the loan from the loan books. There is an index book to the loans ITM663720 (which is currently not digitised) and then this tells you the loan number which tells you in which register book your entry is listed. There are three loan registers currently digitised and viewable at home.

A search for “Workers Dwelling Board” as the Agency will take you to the numbers for the index and loan registers.

A number of the homes in the inner suburbs of Brisbane were built under this scheme. It is not just Brisbane as I saw loans to people in Barcaldine, Rockhampton and other areas around Queensland. It is worth a look to see if your ancestor benefited under the scheme.

Home of Rupert George Weeks, author’s great-grandfather, on the corner of Cochrane and Craig Streets in Red Hill, Brisbane. From author’s personal collection.

Rupert George Weeks, my great-grandfather, was successful application 225 on 22 December 1910. He applied for a loan of £180. The land, corner of Cochrane and Craig Street Red Hill (20 perches/506m2) was valued by the department at £70, the home he had chosen was valued at £200 and the fence at £12. The home built was a two bedroomed workers cottage, on raised stumps with a small open front veranda. As seen from the photo the kitchen was down the back on the right hand side (viewing from the front), as you can see the stove recess. and the living room would have been opposite the kitchen.

Rupert was a tailor, employed by Pike Brothers in Queen Street. He had married Violet Rollason 7 April 1909. The loan was paid off in full on the 3 May 1921. Rupert was quite ill at this time with tuberculosis and for the last few years had been employed as an insurance agent. Rupert sadly died 29 July 1921. Being a widow with two young children, aged 8 and 4, having a home she owned must have been a major relief.

It was not uncommon for one family member to obtain a loan then you see, going through the index that other family members have also gained loans. I know of two of Violet’s brothers and a number of cousins who also applied and got loans under this scheme.

Comments

Housing for People of Small Means: Worker’s Dwelling Act 1909 — No Comments

HTML tags allowed in your comment: <a href="" title=""> <abbr title=""> <acronym title=""> <b> <blockquote cite=""> <cite> <code> <del datetime=""> <em> <i> <q cite=""> <s> <strike> <strong>